The activity of banks has changed substantially in the last decade. The way banking institutions (digitally) transform today dictates their future relevance in an increasingly competitive market. The future depends on their ability to keep up with the change, lead it, nimbly introduce new products, and deliver outstanding customer experiences.

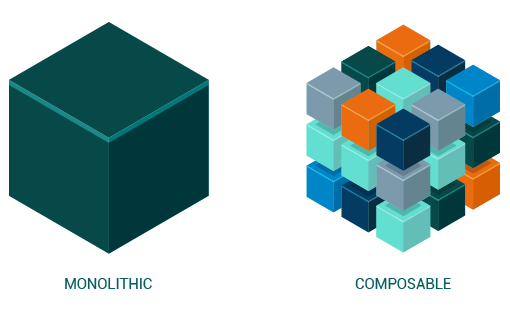

At the same time, a dark shadow threatens this future: rigid, monolithic, archaic, and obsolete banking information systems that significantly hold organizations back.

The new expectations of customers, who increasingly demand greater ease of communication and use of services.